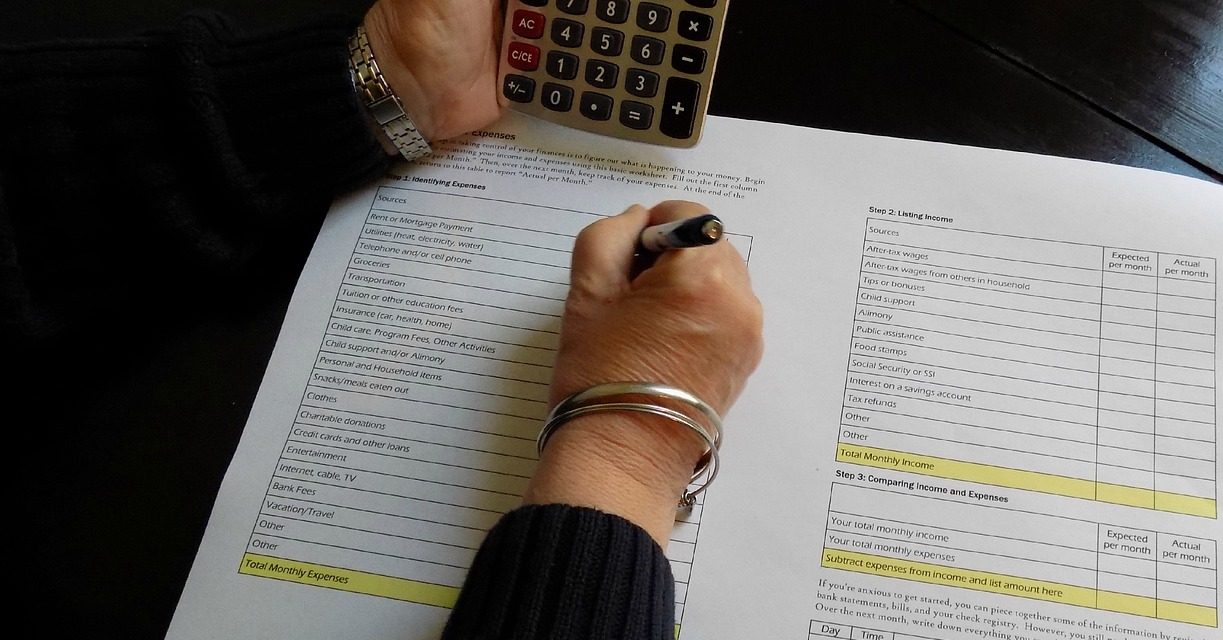

Image by Brandi Day from Pixabay

Jan. 1, 2023-

The stock markets finished 2022 — their worst year since the 2008 financial crisis — as a result of Joe Biden’s tax-and-spend policies.

So for people in their prime earning years, ages 25-54, who are interested in investing in the market should pay off debts and then invest in stocks with money they don’t need.

Translation – that’s money not needed for a rainy day fund, down payment on a house and basic living expenses.

Candidly, I wouldn’t try to beat the market by picking the companies and industries.

More specifically, I’d invest 80 percent or so of such funds in an S&P 500 index fund and 20 percent in a good international fund.

By the time they retire, investors should be in easily liquefied money-market deposits or half in cash. As interest rates increase, then think about CDs.

For a highly sophisticated approach, it makes sense to pay for investment advice – but not pay for investment advice if the advisor will only periodically rebalance your portfolio.

A decent software program can accomplish this for you for less money. A lot less.

Remember the difference between two terms: Advisor and broker. There’s a big difference and it has to do with avoiding someone with a potential conflict of interest.

An advisor is an objective professional to whom you pay a flat fee who is a fiduciary – someone legally obligated to perform in your best interest in choosing bonds, stocks, real estate investment trusts and other investments.

A broker is a person who works for an investment firm. Basically, they’re salespeople who are paid a commission by selling you bonds, stocks, ETFs, mutual funds or other products.

My preference is to pick a proven, bonafide advisor who is registered with the Securities and Exchange Commission.

Personally, I wouldn’t hire someone to actively manage my financial affairs. I’d want to maintain control of my finances. But I would consider hiring an advisor for planning purposes.

Otherwise for expert help, there are five reasons to pay for expertise in financial planning:

1. Developing your investment plan

Your savings rate is the first important consideration. You have to set up a savings schedule and achieve your goal before you start investing.

Before creating a plan, the best investment advisors will ask about your objectives and your financial situation.

You’ll learn how much to save, which accounts to use and which investments to pick.

Again, be sure to pick an advisor for objective advice who isn’t married to a brokerage house. Expect to pay a one-time fee to position you for success in the years to come.

2. Behavioral-investment coaching

Like most things in life, investing involves emotion. But the importance of successful investing necessitates being disciplined and focused.

This means staying with proven principles and not haphazardly switching investments just to chase performance.

Long-term, you’d be better off emulating the approach of the greatest investor of all time, Warren Buffett. He looks for long-term value in a sector he understands.

He’s stuck to his plan even during roller-coaster times.

Behavioral coaching will help you to be stable ala Mr. Buffett in order to profit from your investments.

3. Tax considerations

When it comes to taxes, you have two basic options: A) Tax-advantage accounts such as health savings accounts, IRAs and 401(k) s; and B) Taxable investment accounts.

If you put all your funds in the former, the following information doesn’t pertain to you.

In taxable-investment accounts, you don’t pay taxes on gains until you sell your stocks. The good news is that you’re taxed at a lower rate.

If your stocks pay dividends, then you’re subject to a tax, too, but it’s also at a lower rate.

Interest gains from bonds, however, are taxed as ordinary income.

Therefore, you probably will prefer to put bonds in tax-advantaged accounts while leaving stocks in your taxable-investment accounts.

All of these details is where a good financial advisor can assist you.

4. Socially responsible investments

Some investors like to invest with their social values in mind. That’s the case, for example, in renewable or green energy.

Such investors avoid oil and gas investments vis-à-vis solar or windmill-energy companies. This, of course, requires consulting a green-minded advisor.

If you go this route, be very careful. Do your due diligence. Don’t accept an advisor’s claims at face value. Ask well-thought out questions and research the person thoroughly for expertise and philosophy.

5. Retirement withdrawal strategies

It’s important to learn when and how you should plan for retirement. This can be very complex depending on the size of your portfolio.

You’d be best advised on how much money to take out of the most-logical accounts at the right time.

Three provisos to keep in mind: Your individual needs, applicable taxes and the stock-market conditions.

From the Coach’s Corner, here are more financial strategies:

Money – Your Net Worth Matters More than What You Earn — When it comes to finance, most business owners and other individuals strive to increase their wealth to have more opportunities. The trouble with some, however, is that they focus on income and not their net worth. That means, of course, spending less than they earn.

7 Steps to Wealth and High Net Worth — Creating wealth and enjoying high net worth doesn’t result from pure luck. It takes a certain mindset and strong action. Here are seven proven steps.

Finance: 10 Year-End Tips for Entrepreneurs — If your business slows down in Q4, the holidays are a great to assess your year and plan for the New Year. Like wellness checkups with your doctor, it’s a good time to evaluate your financials.

Business Insurance Tips to Keep Money from Walking Away — As an entrepreneur you’ve worked long hours, scrimping, saving and planning in your fight for survival. But do you regularly take time to financially protect yourself and business?

6 Best Practices to Capitalize on a Business Loan — Whether it’s a business loan, a cash advance against your credit-card income, equipment lease or purchase or commercial mortgage loan, don’t have stars in your eyes. Be pragmatic.

Finance Your Vacation with Credit Card Travel Reward Points — If you plan well, you can finance most of your family’s vacation with travel reward points. The trick is to learn all the ways you can earn points. This entails far more than just buying airline tickets or reserving a hotel room.

“A good plan violently executed now is better than a perfect plan executed next week.”

-George S. Patton

__________

Right here is the perfect website for anybody who really wants

to find out about this topic. You know so much its almost

tough to argue with you (not that I personally would

want to?HaHa). You definitely put a brand new spin on a

topic that’s been discussed for many years. Wonderful stuff,

just wonderful!