April 15, 2024-

Why President Joe Biden’s campaign promise to reverse the President Donald Trump’s tax reform of 2018, protests over taxes are again relevant.

President Biden wants $5.1 trillion in new spending and higher taxes on Americans and business for 2025. (See: Biden Budget Tax Proposals: Details & Analysis.)

Lest politicians forget, we should continue to remember tax protests are just as relevant today as they were five decades ago.

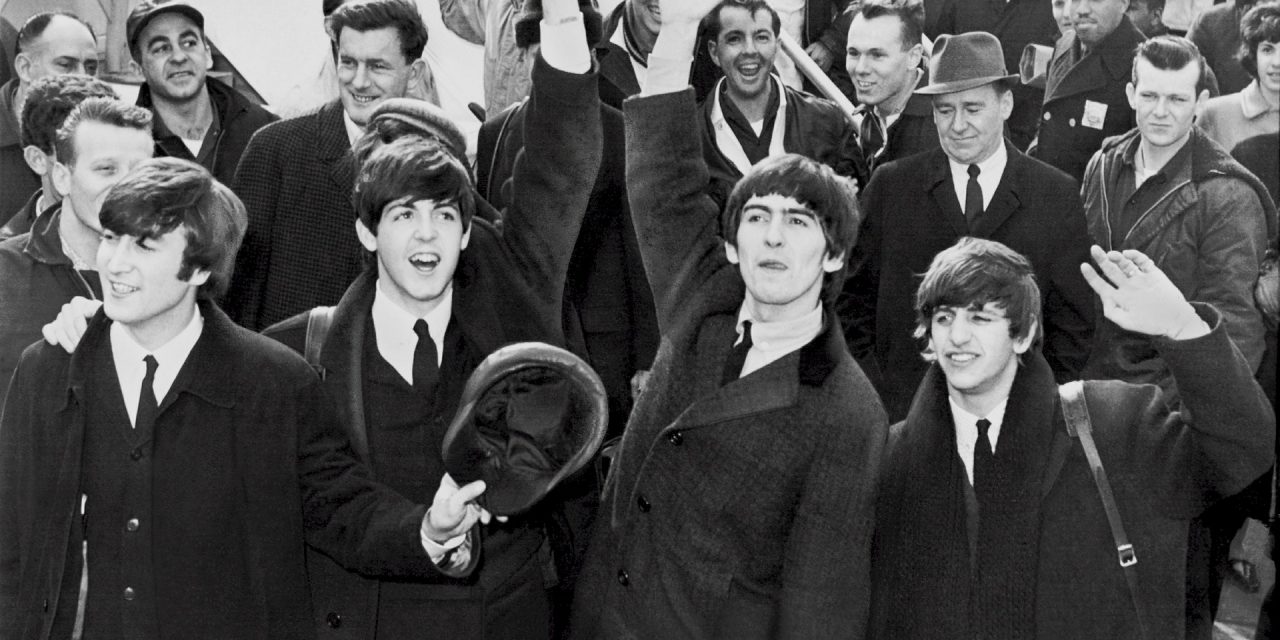

Furthermore, have you ever wondered why British groups like The Rolling Stones, The Who and The Beatles spent so much time touring abroad? To sell music for sure, but there’s another reason.

The reason is best explained in a 1960s’ protest song written by George Harrison. The tune was the opening track of The Beatles’ LP album, “Revolver.” It was Billboard Magazine’s No. 1 album starting in Aug. 1966 for six weeks.

Entitled, “Taxman,” the song ridiculed progressives — in particular, British Prime Minister Harold Wilson — for passing outrageous English tax laws. (Not to be gauche, but indeed the British star passed away at his adopted home of Los Angeles in 2001.)

England has always imposed high taxes but in 1966 the Beatles were viciously abused – led by the liberal Labour Party, the government super-taxed away 95 percent of their earnings. Yes, all but five percent.

“…though we had started earning money, we were actually giving most of it away in taxes,” complained the musician.

Hence, his song:

Fellow Beatle Paul McCartney further explained the reason for the Taxman in a 1984 interview with Playboy.

“George wrote that and I played guitar on it,” said Mr. McCartney. “He wrote it in anger at finding out what the taxman did. He had never known before then what he’ll do with your money.”

So, while the Beatles would be happy with President Trump’s tax reform, reasons for the tax-protest song still exist.

Political distractions on taxes

You might recall not one Democrat voted for tax reform in 2018.

Afterward, as countless companies passed their tax savings and resulting profits to employees, you might recall then-House Minority Leader Nancy Pelosi (D-CA) infamously called the reform-inspired $1,000 to $2,000 employee bonuses “crumbs.”

She and her peers have vowed to raise taxes if given the chance.

Ironically, federal data shows the average wage has increased about 3 percent. But inflation has jumped 18 percent under the Biden Administration.

The white Americans’ unemployment rate remains under 4 percent, but the Black unemployment rate jumped to 6.4 percent in March of this year, climbing from 5.6 percent in February.

Prior to the pandemic, tax reform led to more more jobs. There were more than 7 million unfilled jobs in America. At 3.5 percent. the unemployment rate was the lowest in 50 years. It was historically low for women, blacks and Hispanics.

Who knows? Surely, George Harrison would like to retain Trump tax reform.

From the Coach’s Corner, related public-policy articles:

What Bill Gates Says about Donald Trump Will Surprise You — Mr. Gates astutely observes Mr. Trump was not elected “for specific policies” but for his “kind of leadership.” The tech icon also believes Mr. Trump has a message reminiscent of President John F. Kennedy.

Academic Study: Rich Pay More than Their Share in Taxes — The 2016 study by the National Center for Policy Analysis reveals the current tax code is highly progressive. It’s entitled, “U.S. Inequality, Fiscal Progressivity, and Work Disincentives: An Intragenerational Accounting.”

5 Shocking Lessons from Donald Trump’s Taxes — In analyzing the mess from the mud-slinging over Donald Trump’s taxes, we can reasonably arrive at five conclusions.

“If you’re overweight, I’ll tax your fat.”

-George Harrison

__________